If you’re using a fuel card and notice your fees don’t match up with others using the same provider – or even the rates listed on sites like fuelcard.report – you’re not alone. It’s a common question we hear: Why am I paying more (or less) than other fuel card users? or Your listed card fees don’t match the fees I’m currently paying.

There’s a simple explanation: fuel card fees are flexible. They fluctuate for several reasons, including the size of your fleet, how much fuel your business uses, and the type of deal you signed up for. If you’re wondering why your fees differ and how to get the best deal, let’s dive into the details.

Why Your Fuel Card Prices Have Changed

Wider market & economic factors

Just like fuel prices fluctuate, so do fuel card fees. It’s not just about what’s happening within your provider’s network – it’s influenced by broader market conditions, fuel costs, and even operational expenses. If fuel prices at the pump go up, it’s not surprising that fuel card fees might follow suit.

While these fluctuations tend to apply more to new customers, existing customers may also see changes, though you should receive notice before that happens. This is why your fee might be different from someone who signed up more recently. They could have entered into the market at a time of higher or lower costs.

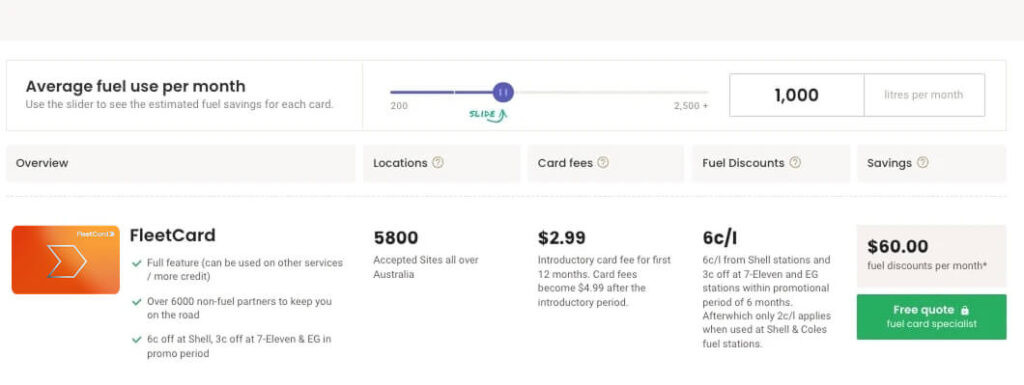

Promotional period ends

Many providers offer introductory rates to attract new customers. These promo periods usually last for around six months, during which you’ll pay a lower fee. After the promo period ends, the fee adjusts to a higher, standard rate.

Sometimes, it’s not obvious you’ve signed up during a promotional period, which is why it can come as a shock when your card fees increase (seemingly without warning).

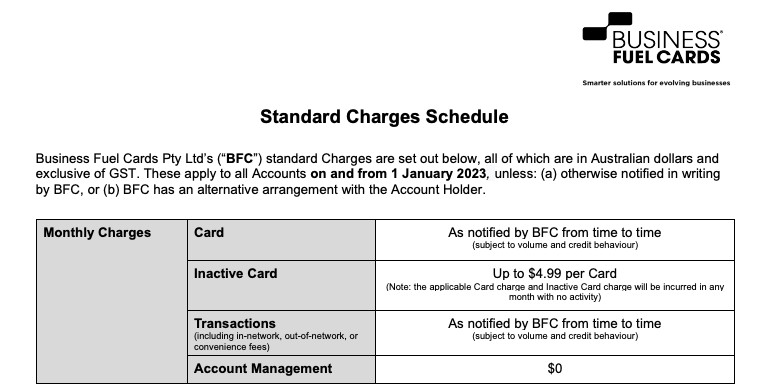

We believe in transparency, which is why we clearly distinguish between promotional fees and standard fees in our account summaries (although “standard fees” don’t exist with some fuel card providers).

You’ll also find with some fuel card provider’s fee schedules, a “standard” price isn’t mentioned because it’s quoted on fuel volume and credit behaviour.

Your volume/credit behaviour has changed

Your current fuel usage and credit behaviour often play a role in the fees you’re charged. If your business has grown and you’re purchasing more fuel, you might qualify for better rates. Or, if you’re spending less on fuel than you did when you signed up, your card fees may increase. However, the fuel card provider should notify you of any changes.

This is why your fees might not match up with others using the same provider. Fuel card providers often adjust fees based on your business’s specific needs, meaning your agreement could be different from that of another business, even if you started with similar terms.

Enquire to save

Why You Don’t Always See Fees Listed Upfront

If you’ve tried looking for a simple, upfront list of fuel card fees online, you might know it can be challenging to find. That’s because fuel card fees aren’t typically standardised across the board. Providers prefer to keep things flexible, allowing them to adjust fees based on your business’s size, fuel consumption, and credit history.

This flexibility is why you might not see a “one-size-fits-all” fee structure, and why your fees may differ from those listed in online reports like FCR.

How to Get a Better Fuel Card Deal

So, with all this in mind, how can you make sure you’re getting the best deal for your business?

Always ask: Is this fee permanent or promotional?

Don’t assume that the first number you see is set in stone. Ask directly whether the fee you’re being quoted is an introductory rate or the regular fee you’ll be paying long-term.

Compare promotional periods across providers.

Just because a fee starts low doesn’t mean it will stay that way. If you’re being offered a promo rate, find out how long it lasts and what the fee will be afterwards. Providers often have promotional periods of six – 12 months, but they can vary.

Look for transparency in fee structures.

Some providers are more open about their pricing than others. Ideally, you want a provider who clearly explains their promotional rates, standard rates, and any possible changes to fees. A transparent breakdown will help you budget more effectively in the long run.

Check if fees depend on your business size.

Be aware that fees can vary depending on the size of your fleet or the amount of fuel you expect to purchase. Larger businesses often get more favourable rates, so if you’re planning to grow, this could work in your favour.

Don’t be afraid to ask for a better deal or consider switching providers.

If your fuel card fees aren’t working for your business anymore, it’s worth having a conversation. Reach out to your provider and see if they can offer a better rate based on your current fuel usage or business growth. And if they can’t give you what you need, don’t hesitate to explore other options – there are plenty of providers out there who might offer a deal that’s a better fit for you.

Is Your Business Eligible for a Fuel Card?

Use the fuelcard.report ELIGIBILITY CHECKER to find out how much you can save with the right fuel card partner.

Enquire to save