What’s the Best Fuel Card for Self-Employed / Sole Traders?

The best fuel card for self-employed drivers depends on your routes, fuel type, and how much admin you want to handle. FleetCard, Shell Card, and WEX-backed cards remain strong all-round options, but BP Plus, AmpolCard, 7-Eleven and United Card also have compelling offers for sole traders. The right pick is the one that fits naturally into how you already drive and spend.

Benefits of a Fuel Card for Self-Employed

Fuel cards were designed to make business driving simpler. Instead of tracking dozens of receipts, you get one monthly invoice that’s GST-compliant, itemised, and easy to upload into accounting software. That’s a big win at tax time.

They also help with:

- Cash flow through interest-free billing periods (typically 21–51 days).

- Control over what can be purchased with the card.

- Discounts that can lower running costs without extra effort.

For many self-employed people, the main value isn’t just in fuel savings but in saving time.

How to Choose the Best Fuel Card if You’re Self-Employed

Step 1: Start with where you drive

Coverage is the most practical place to start. If you’re a tradesperson, courier, or consultant travelling between suburbs or regions, you’ll want a card accepted at multiple brands.

- FleetCard gives access to more than 6,200 stations including Shell, Ampol, BP, United, 7-Eleven, and Mobil.

- Shell Card has about 1,500 Shell and Redd Express sites, with strong metro coverage.

- WEX covers around 6,000 locations across different networks.

- BP Plus, AmpolCard, and United Card suit drivers loyal to a single brand, offering simpler billing and consistent pricing.

If you refuel across mixed brands, a multi-network card usually saves time and planning.

Step 2: Compare ongoing costs and terms

Fuel cards vary in monthly card fees, interest-free days, and transaction charges. Most have no joining or annual fees, so focus on what you’ll pay to keep it active.

| Card | Monthly Fee | Interest-Free Period | Avg. Fuel Discount | Network Size |

| FleetCard | $5.99 | 51 days | 2–3c per litre | 6,200+ sites |

| Shell Card | $2.50 | 0–14 days | 2–4c per litre | 1,500+ sites |

| WEX Motorpass | $5.99 | 0–21 days | 1–2c per litre | 6,000+ sites |

| BP Plus | $2.95–$4.95 | 21 days | 2c per litre | 1,400+ sites |

| AmpolCard | $2.95 | 0 days | 3–4c per litre | 2,000+ sites |

| United Card | $2.99 | 37 days | 4c per litre | 2,000+ sites |

Step 3: Weigh short-term offers against steady value

Promotional fuel discounts can look tempting but often run for only six months. For most self-employed drivers, consistent access to fuel and clear reporting matters more than chasing short-term promos.

Step 4: Think about rewards and extras

If you travel often, choosing a card with a linked rewards program can add extra value over time.

- BP Plus earns Qantas Business Rewards points, which can be useful if you fly for work.

- FleetCard and 7-Eleven Fuel Pass connect to Velocity Frequent Flyer, making them handy for regular Virgin Australia travellers.

- AmpolCard links to Everyday Rewards, which can be converted into Qantas Points.

- Shell Card earns Flybuys, which can also be transferred to Velocity.

Step 5: Match the card to your business structure

Being self-employed means your finances are often tied directly to your cash flow. Cards with longer payment terms, such as FleetCard’s 51-day interest-free window, can provide breathing space. If you prefer a tighter billing cycle, shorter terms from Shell or BP can help you stay disciplined. It’s also worth checking which accounting tools each provider integrates with. If the card integrates easily with Xero and MYOB, it could save you hours of manual entry.

Step 6: Review the fine print

Most cards charge a small surcharge (around 1–1.3%) on Visa or Mastercard payments for invoice settlement. If you pay directly from a business account, you can often avoid that fee.

Also confirm whether the provider charges outside-network fees. For instance, FleetCard is surcharge-free at partner sites (Shell, Ampol, 7-Eleven) but there may be a merchant fee at independent stations.

Best Fuel Card Fit By Type of Self-Employed Driver

For trades and service businesses

FleetCard or WEX Motorpass suit varied routes and mixed fuel brands. They simplify spend tracking and can grow with your business if you hire extra drivers later.

For metro-based professionals or delivery drivers

Shell Card or BP Plus are practical for city coverage, consistent pricing, and easy Qantas Points collection.

For regional or long-distance work

FleetCard or WEX provide the best regional reach with thousands of sites across Australia so you’re never caught out.

The Bottom Line

Choosing a fuel card when you’re self-employed is about finding a card that saves time, fits your routes, and keeps your records clean.

Start by mapping where you refuel most, then compare the cards that make sense for those locations. The best card is the one that quietly takes work off your plate while saving a few dollars each fill-up.

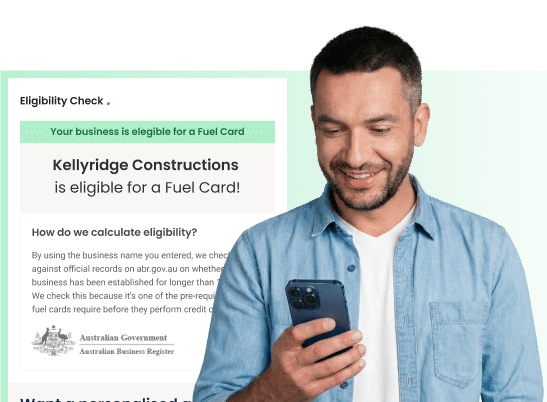

Self-Employed & Looking for the Best Fuel Card?

Check your business’s eligibility in minutes using our online tool and find the best fuel card for your needs.

Enquire to save