Fuel is one of the biggest costs for small Australian businesses, so the best fuel cards are the ones that cut admin, tighten card controls and keep your team moving (not just the ones with the biggest discount offers).

I speak to a lot of small‑business owners who are tired of juggling fuel receipts, fuel card misuse and lack of spend oversight. Over time, I’ve found the best fuel cards for small Australian businesses in 2026 are the ones that balance three things: wide enough network coverage, fair pricing, and strong card controls so you can see, and stop, misuse early. So, these are my top fuel card picks for small businesses this year.

Enquire to save

The Best Fuel Cards for Small Australian Businesses in 2026

| Brand | Rating | Best for | Locations (Aus wide) |

| FleetCard | ⭐️⭐️⭐️⭐️⭐️ | Most widely accepted | 6,000+ sites |

| Shell Card | ⭐️⭐️⭐️⭐️⭐️ | Best for card control | 1500+ sites |

| WEX | ⭐️⭐️⭐️⭐️ | Best for tradies | 6,000+ sites |

| AmpolCard | ⭐️⭐️⭐️ | Best transport & logistics | 1,800+ sites |

| BP Plus Fuel Card | ⭐️⭐️⭐️ | Best for scalability | 1,400+ sites |

| 7-Eleven Card | ⭐️⭐️⭐️ | Best 1-2 car fleets | 700 sites |

The Best Fuel Cards 2026 Overview

If your fleet travels extensively, it can be hard to predict which petrol station will be available when the fuel light turns on. That is where FleetCard comes in. The Fleet Card is widely accepted at 90% of fuel sites in Australia.

In addition, the card can be used at over 6,000 non-fuel partners, including repair centres and motor dealerships.

This high level of acceptance makes Fleet Card a top choice for small businesses that value convenience above all else. Fleet Card also streamlines business management with its consolidated tax invoicing for all transactions.

Plus, with its recent FleetCard+ offering, if you’re looking to switch to your fleet to hybrid/electric, FleetCard has you covered.

As a new small business, it can be frustrating to face rejection from larger fuel card providers like FleetCard due to a lack of financial history.

However, the Shell Card offers a welcoming solution to help get your business on the move. Unlike other providers that reject new businesses that don’t meet the 12-month criteria, Shell is much more accommodating.

They often introduce shorter credit terms for newer businesses, giving them the flexibility they need to manage their fuel expenses.

As you build a stronger credit history with Shell, you’ll gain the ability to extend the credit terms, further helping your business grow. So if you’re looking for a fuel card solution that supports new businesses, the Shell Card is an excellent choice.

With the acquisition of OTR stations in 2024, there are now even more locations to fill up, making it an even smarter choice for your fuel card needs.

As a tradie, your daily routine likely involves managing a fleet of 1-5 vehicles, with your team hitting the road every day to get to various job sites. Ensuring they have access to fuel is essential, especially when you have young apprentices on your team.

However, managing the paperwork for fuel costs can become increasingly complicated as your workforce and fleet grow. That’s where the Motorpass fuel card comes in handy. As a multi-branded fuel card, it can be used to cover all vehicle-related expenses, from fuel costs to maintenance and repairs.

By consolidating all your vehicle expenses on one card, you’ll save valuable time, and money, and reduce paperwork. So if you’re a tradie looking to streamline your fuel expenses and manage your fleet more efficiently, the Motorpass fuel card is a wise investment.

In the fast-paced world of transport and logistics, time is of the essence, and fleet managers are always on the lookout for ways to streamline operations.

Enter the AmpolCard (previously known as Caltex StarCard), an excellent option for those small businesses in transport and logistics who are seeking to optimise fleet management. With the AmpolCard, managing a small fleet of transport trucks is made easy through the use of their user-friendly online dashboard.

This interface provides the tools necessary to track vehicle spending and maintenance, ensuring that your fleet is always in tip-top shape. So, if you’re in the transport and logistics industry and looking for an efficient way to manage your fleet, the AmpolCard is a must-have tool.

If you’re looking to scale your small business, the BP Plus fuel card is an excellent option to consider. With an impressive network of 1,400 national fuel stations, this card is particularly appealing to businesses that rely heavily on BP stations.

While really small businesses may face a premium fee for using the card, costing over $4.95 per card per month, the fees drop to $2.95 per card if you have more than 3 cards. This means that it’s more cost-effective to have three cards than just two.

Moreover, the BP Plus fuel card offers substantial discounts based on volume, meaning that the more fuel you purchase, the more significant the savings. So, if you’re looking to expand your small business and reduce fuel expenses, the BP Plus fuel card is an excellent tool to have in your arsenal.

For small businesses looking to save on fuel costs without breaking the bank, the 7-Eleven Fuel Pass is an excellent option. This budget-friendly fuel card provides a simple way to track fuel expenses and offers some compelling introductory offers.

With an ongoing minimum discount of 2c/l, the 7-Eleven Fuel Pass is tough to beat, and it can be used across the entire WEX Motorpass network.

Best of all, there are no transaction fees associated with using the fuel card at any location, making it an attractive option for businesses of all sizes.

However, it’s worth noting that the fuel discount is only applicable at 7-Eleven sites. But, if you’re looking for a cost-effective way to manage your fuel expenses and regularly use 7-Eleven stations, the 7-Eleven Fuel Pass is an excellent choice.

Why Your SME Needs a Fuel Card

Small businesses need a fuel card because it gives structure and control to one of the hardest costs to manage: fuel. Here’s what it actually does for you:

- Simplifies payments: Drivers use one dedicated card instead of cash or personal cards, so you’re not chasing reimbursements or missing receipts.

- Centralises all spend: Every fill‑up lands on a single, GST‑ready statement, which makes bookkeeping and tax time much faster.

- Improves cost control: You can set rules and limits per card (fuel‑only, spend caps, daily transaction limits) so fuel spend stays within what you’ve budgeted.

- Reduces misuse and fraud: With PINs, controls and alerts, it’s much easier to spot unusual activity quickly instead of discovering it weeks later.

- Gives better visibility: Reporting tools show who’s buying what, where and how often, helping you spot inefficient routes or vehicles that are chewing through more fuel than they should.

All-Brand or Single-Brand Fuel Cards?

Fuel cards in Australia fall under two major types: all-brand and single-brand.

| Card type | Where it works | Typical strengths | Typical drawbacks |

|---|---|---|---|

| All‑brand | Most fuel brands Australia‑wide | Maximum flexibility, peace of mind on routes | Higher fees, usually smaller discounts |

| Single‑brand | One main brand (plus some partners) | Better discounts, lower fees, fewer surcharges | Less flexible, possible out‑of‑network fees |

Which is Best for Your Business?

Choosing between an all-brand or single brand fuel card ultimately depends on your business’s fuel needs and preferences.

- All-brand cards are more flexible but may come with additional fees

- Single brand-cards offer better discounts and lower fees but restrict you to a specific fuel station.

Considerations When Choosing a Small Business Fuel Card

When I’m choosing a small business fuel card, I usually work through a short checklist:

- Fuel station coverage: I start by checking where your team actually fills up now, then match that against each card’s network. Some cards are multi‑brand and work almost everywhere; others are tied to a single brand or region, which is fine if your routes are predictable.

- Discounts and savings: Discounts help, but I look closely at how long they last and what happens after the promo period. A modest, ongoing 2–4c per litre can be more useful than a big 6‑month teaser that disappears and leaves you with higher fees.

- Fees and charges: Monthly card fees, transaction fees, surcharges and late‑payment penalties can quietly eat into your savings. I like to run rough numbers on what you’ll pay in fees over a year, not just month‑to‑month.

- Payment options: Some providers only do direct debit; others offer more flexible terms. It’s worth choosing a setup that matches your cash‑flow rhythm so you’re not constantly juggling due dates.

- Reporting and analytics: Good reporting can show you which vehicles or drivers are using more fuel than expected and where your money is really going. I pay attention to whether you can filter by vehicle, driver, site and fuel type, not just download a basic CSV.

- Card controls and alerts: This is a big one now. I look for the ability to lock cards to fuel‑only, cap spend or litres per card, limit daily transactions and set real‑time alerts for unusual activity. Some cards, like Shell’s, are particularly strong here, which can make a big difference if you’re worried about misuse.

- EV charging capabilities: If you’re starting to add hybrids or EVs, it’s worth checking whether the provider supports charging (either through its own network or partners). That way you’re not swapping systems again the moment you plug a new type of vehicle into your fleet.

Corporate Credit Card Vs Fuel Card

Choosing between a corporate credit card and a fuel card depends on your business’s specific needs. Here’s how they differ:

| Feature | Corporate credit card | Fuel card |

|---|---|---|

| Main purpose | All business expenses (travel, meals, subscriptions, etc.) | Fuel and vehicle‑related spend for your fleet |

| Where it works | Almost everywhere cards are accepted | Only at participating fuel/auto merchants |

| Spend control | Harder to restrict categories and merchants | Strong controls: fuel‑only, per‑card limits, blocked categories |

| Reporting detail | Basic transaction lists by merchant and amount | Fleet‑specific data (fuel type, litres, cost per unit, vehicle/driver) |

| Fleet insights | Limited visibility into vehicle performance | Can show cost per km, km per litre and high‑usage vehicles |

| Rewards & perks | Broad rewards (points, cashback, travel perks, insurance) | Fuel‑focused rewards and discounts, some loyalty program links |

| Fraud risk | Higher exposure; card can be used almost anywhere | Lower exposure via closed networks, PINs and tighter usage rules |

| Fuel cost separation | Fuel spend mixed with all other expenses | Fuel costs kept in a dedicated account and statement |

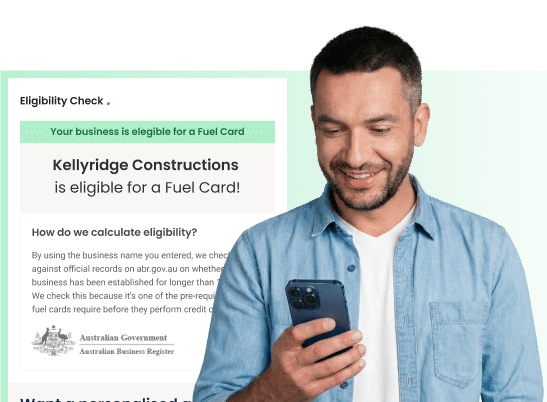

Is Your Business Ready for a Fuel Card?

Enquire to save

Check if your small business is eligible for a fuel card today with Fuel Card Report’s eligibility checker. Simply enter your details, and our tool will align you with the most suitable fuel card options tailored to your business needs.

Don’t delay in streamlining and economising your fuel expenses. Check today and find the perfect fuel card to help your small business save both time and money.